Check out three new ways to bank

A checking account is the primary method to access funds for most Americans. They provide a safer means to store funds and more convenient access to your money than virtually

any other solution available today. With convenience as a focal point, Central Sunbelt provides 24 hour access to checking account funds with easy-to-use debit cards, digital wallet payment services, one of the largest ATM networks in the world, cash and check deposits via ATM, check deposits by phone, and mobile / online banking to monitor it all. Paired with low fees and the ability to earn interest, Central Sunbelt aims to provide the best viable checking account available to give account holders (whom happen to be owners of the credit union) an optimal financial management tool with the most requested benefits and more.

Being member owned and giving each and every member a voice allows Central Sunbelt to take all needs and wants into account to help better all available products and services. As with just about everything in life, different people have different needs and one size never fits all. That's why Central Sunbelt decided to change the checking account lineup to now provide three distinct solutions; Advantage Checking, MyLife Checking, and Cloud Checking. Whether your goal is to receive the highest paid earnings in dividends (banks call this interest), the utmost financial management and security, or a simple and easy to use mobile account on the go, you can find the right checking account to best fit your goals in life. Learn more about the three options below:

Advantage Checking

Perfect for high earners and those with high ATM usage

This is the perfect account for those looking for higher earnings and the ability to access virtually any ATM in the world without ever having to pay an ATM fee! Advantage Checking gives you access to higher earnings; as much as 3.0% APY paid every month and ATM refunds up to $25. This checking account is free with a few easy qualifications that coincide with 'going green' and using various online services such as e-statements and direct deposit.

Learn more about Advantage Checking

MyLife Checking

A great tool for monitoring, maintaining, and protecting your credit / identity and included value for monthly savings

This account explores going beyond a traditional checking account and bringing value while building and protecting one's financial wellness. MyLife Checking delivers brand new protections to monitor and safeguard your credit / identity, protect your cell phone(s), and save money along the way. Most Americans pay monthly for cellular phone insurance (upwards of $15 per phone) and identity theft prevention services such as Lifelock (upwards of $30 a month). Being a not-for-profit member owned institution means Central Sunbelt is able to take these same services and deliver them in a much lower cost format than a for-profit company is able (such as Lifelock for example).

There's a lot to say about what MyLife Checking offers so we have a break down of the benefits below using the collapsable menu:

IDProtect

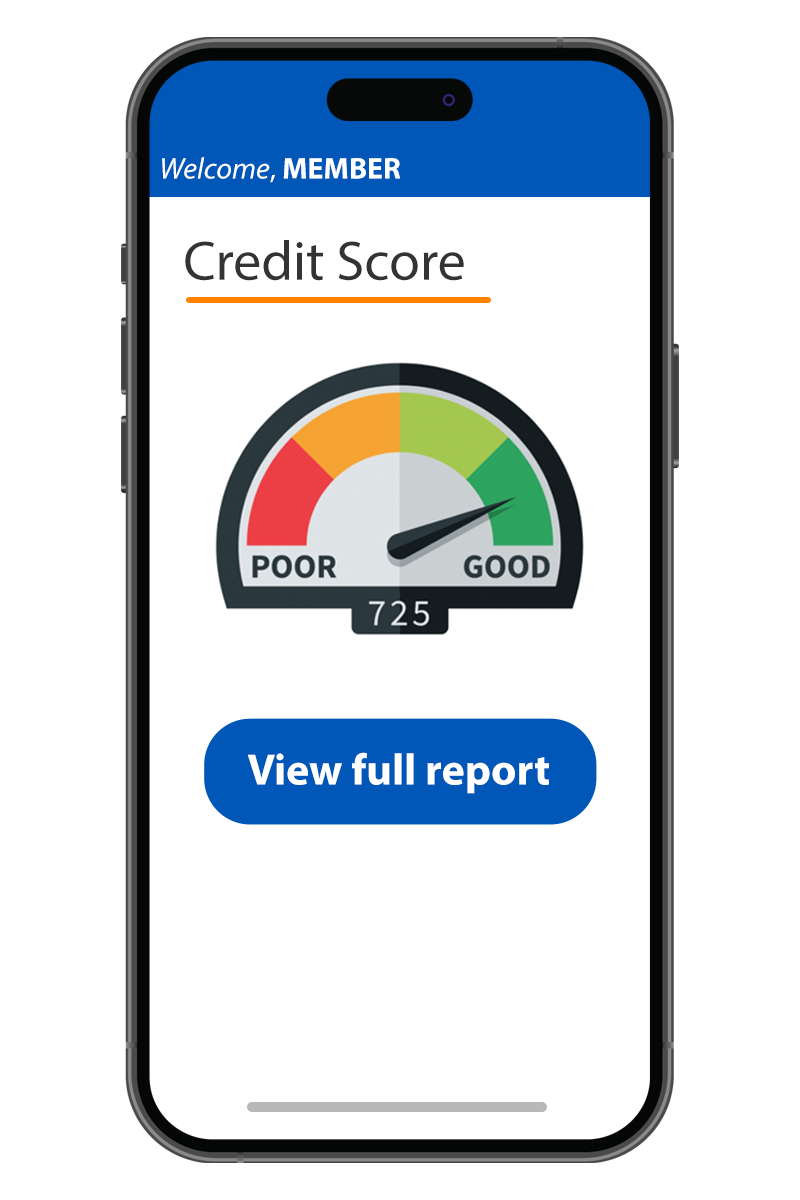

Monitor and protect your credit, credit score, and identity with IDProtect®

IDProtect® is a premium Identity theft monitoring and resolution service1, that includes credit file monitoring2 and alerts of key changes with Equifax, Experian, and Transunion, ability to request a 3-in-1 report every 90 days or upon receipt of a credit alert, monitoring of over 1,000 data bases and up to $10,000 in identity theft expense reimbursement3, and more.

Registration/activation required.

- Credit Report / Score

- Identity / Credit Monitoring

- Identity Theft Reimbursement

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students.

2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation.

3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

Cell Phone Protection

A modern reward for modern tech. We love our phones, but they do break and get lost or stolen.

Receive up to $300 of replacement or repair cost for damaged or stolen phones. This protection covers the first three phones listed on your cellular telephone bill.3

Mobile phone bill must be paid through this account.

- Covers up to 3 phones

- Protects up to $300 per claim

- Amazingly low replacement deductible

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students.

2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation.

3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

Telehealth

MyLife Rewards offers Telehealth services.

Telehealth1 provides access to 24/7 video or phone visits with U.S.-based board-certified, licensed and credentialed doctors ready to care for you and your family.

There are zero copays and no surprise bills, plus discounts on prescriptions and lab work.

Telehealth covers non-emergency, urgent care for things like allergies, sinus infections, flu, strep throat, bronchitis, hypertension, rashes, acne and more. Therapists and counselors are also there to help work through all kinds of mental and behavioral health, including depression, divorce, grief, loss and addictions.

Registration/activation required.

1 Available for the account holder and their spouse/domestic partner and up to six (6) dependent children age 2 and older. This is not insurance.

Learn more about MyLife Checking

Cloud Checking

For those who prefer to bank on the go

Whether you're a student, like to travel, or even enjoys to stay and bank at home, Cloud Checking is the perfect way to stay tuned into your account 24/7/365 and make banking fit your unique lifestyle. Cloud Checking gives you access to all the mobile banking tools and the same vast network of over 60,000 free ATMs with no cost. Cloud Checking requires no minimum balance to open or maintain and even gives you the ability to earn dividends (banks call this interest)!

Learn more about Cloud Checking

All accounts have no minimum balance to open or maintain, no charge to use your debit card, and the ability to earn interest! If you're a Central Sunbelt member or anyone looking to get more out of your traditional checking account, let us know and we can help pair you with the best checking account to fit your needs.

Extended network of over 60,000 ATMs available with Sunbelt Check Card using Advantage Checking. Qualifying for Advantage Checking requires 10+ transactions totaling $100 or more, enrollment to Cloud Documents in the Cloud Branch online, and a minimum of 1 ACH deposit or direct deposit post per calendar month.APY=Annual Percentage Yield. Qualifying required to receive full benefits of Advantage Checking each month. Members who do not meet monthly requirements will receive standard paying dividend rates, be excluded from ATM fee reimbursements, and incur a fee. See fee disclosure for details on fee amount. Rates subject to change at any time. CSFCU is not responsible for the methods merchants use to process transactions. Transactions must post during the calendar month. Please review your account history to verify qualifying transactions. Cloud Pay users paying 2 bills or more per calendar month avoid a monthly service fee. See current fee schedule for updated fee amount. Service charges may apply for particular checking accounts or other associated services. Qualifying required for membership and select services. Call for details.

« Return to "Blog" Go to main navigation